Definition of a Ponzi Scheme (Fraudulent Investing Scam)

Ponzi Scheme is an abbreviation for Ponzi Scheme.

What Is a Ponzi Scheme and How Does It Work?

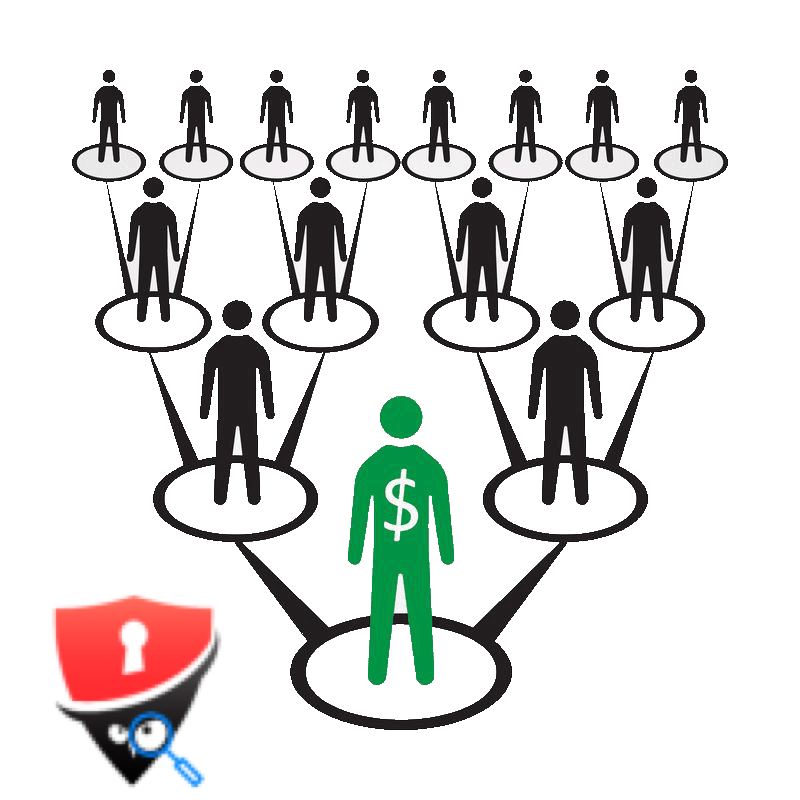

A Ponzi scheme is a fraudulent investment scheme that promises investors enormous rates of return while posing little risk to them. A Ponzi scheme is a fraudulent investment operation in which returns are generated for earlier investors by using money acquired from later participants to fund the earlier investors’ gains. This is comparable to a pyramid scheme in that both are dependent on the use of new investors’ monies to pay off the previous backers who have contributed to the program.

Both Ponzi schemes and pyramid schemes eventually reach their nadir when the inflow of new investors ceases and there isn’t enough money to go around for all of the participants. The plots begin to fall apart at this stage.

IMPORTANT TAKEAWAYS

The Ponzi scheme, which is similar to a pyramid scheme, creates returns for older investors by attracting new investors who are promised a high reward with little or no risk.

For both fraudulent schemes, the underlying assumption is that the new investors’ monies will be used to reimburse the original investors.

The companies that participate in a Ponzi scheme devote all of their resources on obtaining new clients who will invest their money.

Understanding the Operation of Ponzi Schemes

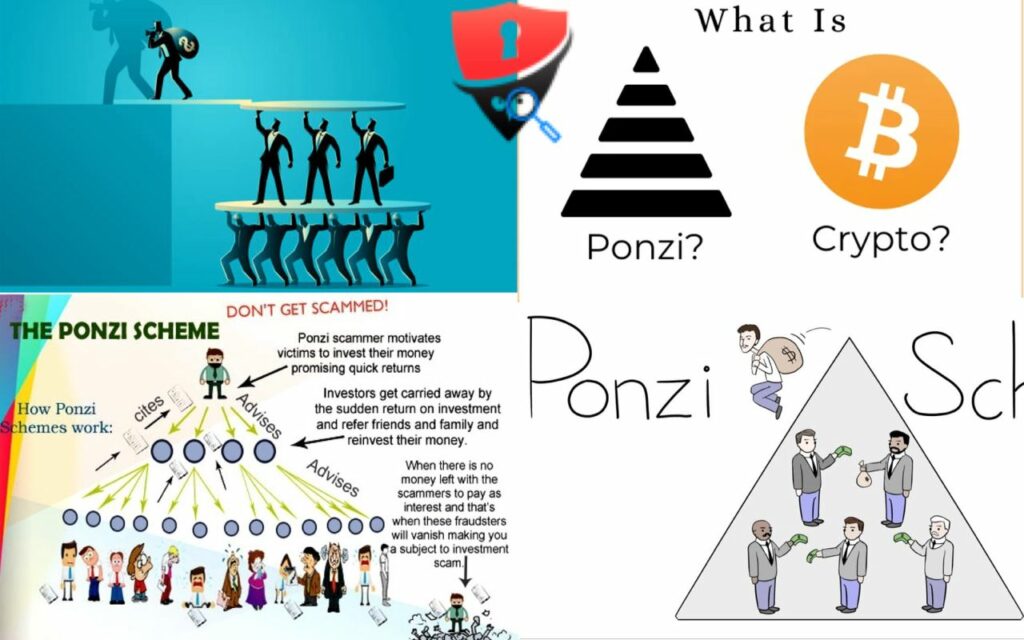

Clients are promised high profits with little or no risk when they engage in a Ponzi scheme, which is investment fraud. The companies that participate in a Ponzi scheme devote all of their resources on obtaining new clients who will invest their money.

This additional money is utilized to pay the returns due to the original investors, which is denoted as a profit from a valid transaction. Ponzi schemes rely on a steady inflow of new investments to ensure that older investors continue to get returns on their investments. When this supply of money is out, the scam comes crashing down.

The origins of the Ponzi scheme are unknown.

The term “Ponzi Scheme” was coined in 1920 in honor of a swindler by the name of Charles Ponzi. But the first documented cases of this type of investment scam may be traced back to the mid-to-late-1800s when Adele Spitzeder of Germany and Sarah Howe of the United States staged schemes that defrauded investors of their money. According to Charles Dickens, the methods of what would become known as the Ponzi Scheme were described in two independent novels, Martin Chuzzlewit (1844) and Little Dorrit (1857), both of which were published in the same year.

The United States Postal Service was the target of Charles Ponzi’s first scheme, which began in 1919. At the time, the postal service had invented international reply coupons, which allowed a sender to pre-purchase postage and include it with their communication. After receiving the coupon, the recipient would take it to a local post office and exchange it for the priority airmail postage stamps that would be required to send a response.

Arbitrage is the term used to describe this form of exchange, which is not considered to be illegal. Ponzi, on the other hand, became hungry and increased the scope of his operations.

Under the name of his organization, Securities Exchange Company, he promised returns of 50% in 45 days or 100% in 90 days if the investment was made. Following his success with the postal stamp system, investors were quickly attracted to his business venture. Ponzi did not truly invest the money; instead, he just divided it among his investors and claimed that they had made a profit. The Securities Exchange Company was investigated by The Boston Post in August of 1920, after which the plan was discovered and shut down. Ponzi was arrested by federal authorities on August 12, 1920, as a result of the newspaper’s investigation. He was charged with many charges of mail fraud and sentenced to prison.

Red Flags of a Ponzi Scheme

The concept of a Ponzi scheme did not die out in 1920, as some believed. As technology progressed, the Ponzi scam evolved as well. When Bernard Madoff was convicted of conducting a Ponzi scheme in 2008, it was revealed that he had manipulated trading data in order to pretend that clients were making money on assets that did not exist. The date of Madoff’s death in prison is April 14, 2021.

Regardless of the technology employed in the Ponzi scam, the majority of them have the following characteristics:

Guaranteed big profits with low risk are what you get with this investment.

The uninterruptible flow of profits regardless of market conditions

The Securities and Exchange Commission does not recognize investments that have not been registered with the agency (SEC)

Investment strategies that are kept hidden or characterized as being too hard to explain Clients who are not permitted to access official papers pertaining to their investment strategy

Clients who are having difficulty withdrawing their funds

2 Compete without taking any risks with $100,000 in virtual cash.

Make use of our FREE Stock Simulator to put your trading talents to the test. Compete against thousands of other Investopedia traders and trade your way to the top of the leaderboard. You should practice submitting transactions in a simulated environment before putting your personal money at risk. Practice trading methods so that when you’re ready to enter the actual market, you’ll have the experience you’ll need to be successful in it. Try our Stock Simulator for free right now >>

Ponzi Scheme is an abbreviation for Ponzi Scheme.

A fraudulent investment business in which payments collected from new investors are used to pay off payments obtained from prior investors

What is a Ponzi Scheme and how does it work?

A Ponzi scheme is a type of investment program that is deemed fraudulent. It entails leveraging payments received from new investors to pay down the debt owed to the original investors. Ponzi scheme organizers typically promise that they will invest the money they gather in order to earn supernormal profits with little to no risk. However, this is not always the case.

However, in the real world, scammers do not intend to use the money for any other purpose. Their goal is to pay off the initial investors in order to make the plan appear credible to others. As a result, in order to be viable, a Ponzi scheme requires a continuous flow of funds. As soon as organizers are unable to attract any more participants and/or as soon as an overwhelming majority of current participants choose to cash out, the plan comes crashing down.

Ponzi schemes are being dismantled.

A Ponzi scheme is essentially a form of investment scam in which investors are promised large returns in exchange for their money. Companies that are involved in Ponzi schemes devote all of their resources to attracting new customers to their business. Upon making an investment, the money is collected and utilized to pay the original investors, who are referred to as “returns.”

A Ponzi scheme, on the other hand, is not the same as a pyramid scam. In a Ponzi scheme, investors are led to feel that they are receiving returns on their investments while in fact, they are not. Participants in a pyramid scheme, on the other hand, are well aware that the only way for them to profit from the system is to recruit additional individuals into the scam. Ponzi schemes are, to a large part, deceptive investment scams.

Ponzi schemes are characterized by several red flags.

The majority of Ponzi schemes have some characteristics in common, such as:

- The promise of large rewards with a low level of risk

In the real world, every investment entails a certain level of risk, regardless of the amount invested. In fact, high-yielding investments are often associated with higher levels of risk. Consequently, if someone proposes an investment with large returns and low risks, it is likely to be a scam or a bargain that is too good to be true. There is a good chance that the investment will not receive any returns.

- Returns that are excessively constant

Investments are subject to regular swings in value. A person who makes an investment in the stock of a firm will experience periods of increased and decreased share price, depending on the company’s financial performance. Having said that, investors should always be wary of assets that provide large returns on a constant basis, regardless of how the market is performing at the time.

- Investments that are not registered with the government

Before entering into a scheme, it’s crucial to check whether the investment company is registered with the Securities and Exchange Commission (SEC) or with state regulators in your jurisdiction. If it is registered, an investor will be able to access information about the firm in order to establish whether or not it is real.

- Sellers who are not authorized

Individuals must hold a special license or be registered with a governing organization in order to operate legally under federal and state law. The vast majority of Ponzi scams involve unregistered persons and businesses.

- Strategies that are both secretive and smart

It is best to avoid making investments that are comprised of procedures that are difficult to comprehend.

The Evolution of the Ponzi Scheme

The plan was named after a conman named Charles Ponzi, who defrauded hundreds of investors in 1919 and was sentenced to prison.

Ponzi claimed a 50 percent return on revenues made from overseas reply coupons within three months of receiving the money. The postal service used to offer international reply coupons, which allowed a sender to pre-purchase postage and include it in their mail back when it was available. The coupon would then be exchanged for a priority airmail postage stamp at the receiver’s local post office by the recipient.

In the past, it was not uncommon to find that stamps were more expensive in one country than in another, owing to changes in postage prices. As a result, Ponzi identified an opportunity in the practice and hired agents to purchase low-cost foreign reply coupons on his behalf, which were subsequently delivered to him. He swapped the coupons for stamps, which were more expensive than the coupons that he had originally purchased with the money from the coupon. After that, the stamps were sold at a higher price in order to make a profit. Arbitrage is the term used to describe this form of trading, which is not unlawful.

Ponzi, on the other hand, developed a greedy streak at some point. He solicited people to invest in the company through the Securities Exchange Company, guaranteeing them 50 percent returns within 45 days and 100 percent returns within 90 days if they did so. No one had any doubts about his intentions after his success with the postage stamp idea. Unfortunately, Ponzi never actually invested the money; instead, he simply re-invested it back into the plan by repaying some of the investors’ money. The Securities Exchange Company was probed in 1920, after which the scam was brought to an end.

Protection Against Ponzi Schemes: What You Need to Know

In the same way that an investor investigates a firm whose stock he intends to purchase, an individual should conduct due diligence on anyone who assists him in managing his financial affairs. The simplest approach to go about it is to contact the SEC and inquire as to whether or not its accountants are currently investigating any open cases (or investigated prior cases of fraud).

Also, before investing in any scheme, one should request a copy of the company’s financial records in order to determine whether or not the scheme is legitimate.

The Most Important Takeaways

A Ponzi scheme is nothing more than an illicit investment plan. With its name derived from Charles Ponzi, a con artist who operated in the 1920s, the Ponzi scam promises regular and large profits while posing as having very little risk. Although such a scheme may be successful in the near term, it will eventually run out of money. As a result, investors should always exercise caution when considering assets that appear to be too good to be true.

These are essentially pyramid marketing schemes that promise investors instant wealth in exchange for a small investment of their time and money. However, they frequently collapse without warning, leaving investors out of pocket.

What is the mechanism by which Ponzi schemes operate?

People are promised significant sums of money in exchange for their investments, and at first glance, the scheme appears to be successful. New investors are drawn in as a result of this early success, and their funds are utilized to repay the original investors, so perpetuating the cycle.

If the following three conditions are met, a Ponzi scheme appears to be successful:

New investors are putting money into the market.

Investors are not immediately demanding repayment of their investments.

Both parties continue to think that they will receive a return on their initial investments.

What is it about Ponzi schemes that make them fail?

Money that has been invested is constantly being recycled,’ and the company never generates a true profit – it simply redistributes the money, claiming growth, and claiming that it is doing well. Ponzi schemes are fundamentally a hoax. As long as new investors continue to put their money into the company, the corporation appears to be doing well for itself.

When individuals stop investing, however, the scam comes crashing down, usually leaving the person at the top with all of the money.

Is it always the case that Ponzi schemes are scams?

Regardless of the method used, a Ponzi scheme is always a scam since it is based on the promise of making payments that never materialize.

Unfortunately, they might be difficult to detect until the company goes out of business and you are unable to access your investment.

What to Look for in a Ponzi Scheme

The following are the primary indicators of a Ponzi scheme:

You’re promised a guaranteed return with little or no risk (there is no such thing – legitimate investment possibilities make it clear that there is a possibility of losing money).

You’re being pushed into making decisions that you’re not quite comfortable with.

On the internet, you can find nasty evaluations, and the company’s social media pages are strewn with customer complaints.

Nothing makes sense to you since you don’t comprehend the terminology. Everything sounds like jargon.

In addition, you are confused about how the scheme operates, and the folks in control are adamant about not disclosing how the company makes money.

You’ve been instructed to keep the investment a secret from your family and other acquaintances.

There are difficulties in obtaining papers and/or official documents in some cases.

If you ask to withdraw your money and are presented with a litany of reasons to keep your money in the scheme, the persons in control will frequently attempt to discourage investors from withdrawing their money by providing even bigger returns for remaining put.

You should always check the Financial Services Register to determine if the company that is communicating with you is regulated by the Financial Conduct Authority if you are in any doubt (FCA). If you’re thinking about making an investment, you should think about receiving independent financial counsel before you put any of your money into the venture.

What to do if you believe you have been duped by a Ponzi scheme

Cancel all future payments on your account.

Turn off all forms of contact.

Document any correspondence you’ve had with the company, such as emails or letters – these may be useful in providing evidence if you need to claim that you were defrauded in the future.

Report the program organizers to the Financial Conduct Authority (FCA) on 0800 111 6768.

Scammers frequently sell people’s personal information, so be on the lookout for scammers who use various identities to attack you again.

You should be aware of the existence of “fraud recovery fraud,” which occurs when scammers pose as police officials or legal specialists and offer to assist victims of fraud in reclaiming their money. They promise to be able to assist you in recovering your money, but they charge a fee.

What are my options if I’ve been the victim of a Ponzi scheme and want my money back?

The problem with recovering money from a Ponzi scheme is that people readily hand over their money, frequently without first ensuring that the organization in which they are investing is legitimate.

As long as the authorities believe that the fraud was not your fault, you would most likely be able to get your money back if your identity had been stolen or your bank account had been targeted by scammers.

Taking prompt action and seeking competent legal counsel, according to the Financial Conduct Authority, is the most effective approach to increase your chances of obtaining some money returned to you.