In recent times, the crypto arena has witnessed its fair share of innovations, but it’s also become a breeding ground for illicit activities. One such dubious entity that has captured significant attention is the Laxsson crypto project. After months of speculation, SnoopHunter‘s in-depth investigation has finally lifted the veil, revealing Laxsson as a Ponzi scheme with a staggering $357 million in transactions.

Breaking Down the Scheme:

- Cryptocurrency as a Facade: While Ponzi schemes aren’t new, the use of cryptocurrency as a medium gives schemers an added layer of perceived legitimacy and complexity. Laxsson cleverly used this digital veneer to mask its fraudulent activities, promising high returns to lure unsuspecting investors.

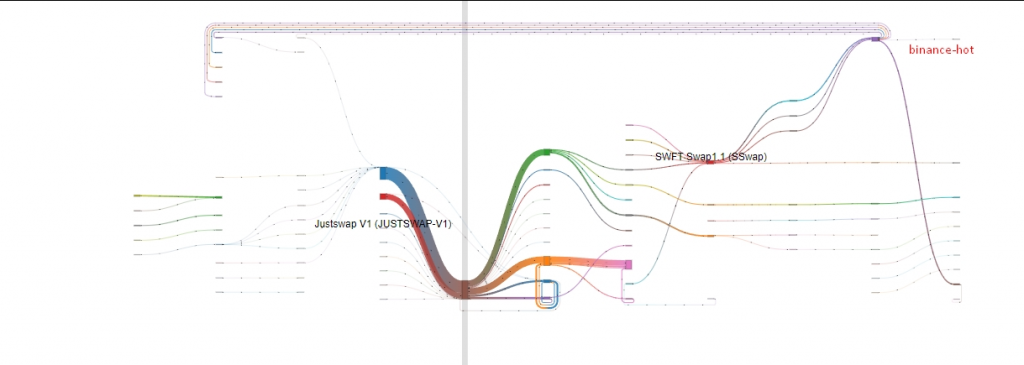

- Flow of Funds: SnoopHunter‘s analysis traced an intricate web of transactions across 36 associated Laxsson wallets. These wallets collectively showed a net flow of $357 million. Alarmingly, over $42 million was directed towards major cryptocurrency exchanges, suggesting a systematic cash-out strategy.

- Deceptive Tactics: Laxsson employed a series of transient wallet addresses. These temporary wallets were used to momentarily house funds before swiftly transferring them to primary wallets. This quick shuffling aimed to obscure the money trail, but the immutable nature of blockchain transactions laid bare these maneuvers.

- The ITP Corp Connection: Further complicating the narrative, SnoopHunter identified startling similarities between Laxsson and another suspicious project, ITP Corp. The operational overlap, from wallet structures to transaction patterns, indicates a potential shared origin, possibly rooted in Asian regions.

Lessons for the Crypto Community:

The uncovering of Laxsson’s Ponzi scheme serves as a stark reminder of the pitfalls within the crypto universe. As the space continues to evolve, so do the tactics of those looking to exploit it.

- Vigilance is Key: Investors should approach offers of exponential returns with caution. It’s essential to conduct thorough due diligence before committing funds.

- Educate and Inform: Awareness campaigns and educational initiatives can equip potential investors with the knowledge to discern genuine opportunities from scams.

- Collaborative Monitoring: Platforms, exchanges, and regulatory bodies should collaborate more closely, sharing data and insights to identify and shut down such fraudulent schemes promptly.

In Conclusion:

Laxsson’s exposure as a Ponzi scheme by SnoopHunter is a testament to the power of diligent investigative work in the crypto domain. As the digital currency landscape matures, it’s crucial for stakeholders to remain alert, informed, and proactive in safeguarding the community’s interests. The promise of quick riches can be alluring, but as Laxsson has shown, the risks are profound. Stay informed, stay safe.